|

|||

|

|

|

||

|---|---|---|

|

||

|

||

|

||

|

||

|

||

|

||

|

|

|

|

Understanding the Cash Out Refinance Loan ProcessA cash out refinance loan is a financial strategy that allows homeowners to leverage the equity in their homes. This type of loan can be an effective way to access funds for various purposes, including home improvements, debt consolidation, or other significant expenses. What is a Cash Out Refinance Loan?A cash out refinance loan involves replacing your existing mortgage with a new, larger mortgage, providing you with the difference in cash. This option is viable for those who have built up significant equity in their homes. How It WorksWhen you apply for a cash out refinance, the lender evaluates your home's current value and your remaining mortgage balance. The lender will then provide you a new loan that is higher than your current balance, and you receive the difference as a lump sum. Benefits of Cash Out Refinance

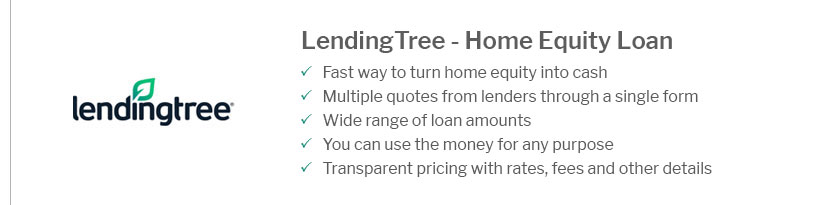

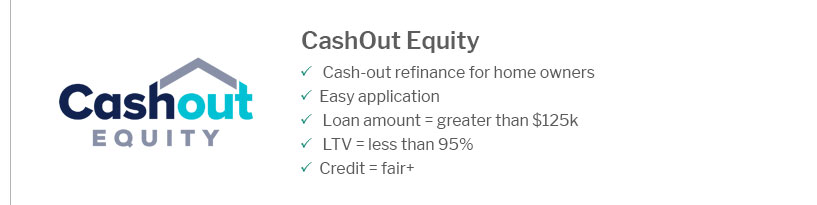

Considerations Before Opting for Cash Out RefinanceWhile a cash out refinance can be beneficial, it is crucial to consider the following factors: Eligibility CriteriaEligibility for a cash out refinance depends on factors like your credit score, income, and the amount of equity in your home. It's advisable to check with mortgage companies in usa for specific requirements. Costs InvolvedRefinancing generally involves closing costs, which can range from 2% to 5% of the loan amount. Be sure to account for these costs when deciding if refinancing is the right choice for you. Comparing to Other Loan OptionsWhen considering a cash out refinance, it's essential to compare it with other options such as home equity loans or a fha 30 fixed rate mortgage. Each option has its own set of advantages and potential drawbacks.

FAQs

In conclusion, a cash out refinance loan can be a powerful financial tool if used wisely. It is important to assess your financial situation, research thoroughly, and seek professional advice to make an informed decision. https://www.freedommortgage.com/cash-out-refinance

A cash out refinance lets you borrow money from your home's equity. With a cash out refinance, you replace your current mortgage with a new mortgage for a ... https://www.rocketmortgage.com/learn/cash-out-refinance

A cash-out refinance replaces your existing mortgage with a higher loan amount, while home equity loans and lines of credit are additional ... https://sf.freddiemac.com/working-with-us/origination-underwriting/mortgage-products/cash-out-refinance

Credit Fees. A Cash-Out Refinance Mortgages Indicator Score / Loan-to-Value (IS/LTV) credit fee in price applies. - Delivery Requirements - Down Payment or ...

|

|---|